Why Are the Emirates (UAE) Supporting the RSF?

November 16th, 2024 - written by: Emirates Working Group

For this blog post, we have compiled material about the Emirates (UAE). The Emirates are often seen as players on the sidelines, when it is not about major sporting events, airlines, conferences or tourist highlights. In fact, however, UAE is a prototype for a new model of regional imperialism: Extractionism, development by displacement, and the making of a low-paid labour force without democracy. The Emirs see labour as a returnable imported commodity, the function of the state is maintained by a small Emirati elite with servants from all over the world, and extractionism results in militia wars, displacement, and hunger crisis, especially in Sudan.

In our Dossier on Sudan, our main interest was the Sudanese Revolution, and the social basis of this revolution, namely the Resistance Committees, and the social networks of the everyday life, and also the growing strength of the women in the revolutionary process, and the overcoming of „tribal“ sentiments.

We have then analysed the War in Sudan as a destruction of that revolutionary social fabric. Now, the longer this war is going on, the more we are concerned with the UAE asserting their interests and securing their investments at all costs, against all precepts of humanity. And more and more we see that UAE is not only securing their investments, but clearing new fields for investment, by displacing the population.

Please note: This text is work in progress. It is not yet well elaborated, but it might be useful for further discussions. We apologise for any overlaps in the text.

Last Updated: 25.11.24

Who could stop UAE?

It is impossible to talk about the war in Sudan without shedding light on the role of the UAE. Authoritarian, aligned with the West, engaged in war against any revolutionary uprising, a paragon of global capitalism, a leader in the exploitation of uprooted labour and the valorisation of African resources. the Emirates are a major player in the background of war, displacement and genocide around the Red Sea and beyond.

What power could stop them? The Emirates have nothing to fear from the political class in the USA nor in Europe. The special friendship with the then - and now newly elected - US President Trump, the hosting of US military bases, the recognition of Israel in the Abraham Accords, and the "energy partnership" with Germany - all this has been headlines in recent years. Behind these headlines, there is a silent accord, which dates back to the 1970s and can be traced back to the mechanism of "petrodollar recycling".

In the early 1970s, the situation in the Western economies was characterised by workers' struggles: wage demands and the struggles for the expansion of the welfare state caused inflation, which was exacerbated by rising energy prices. In this situation, the "oil crisis" of 1974 became a game changer: siphoning off mass purchasing power, and accumulation of dollar assets in the hands of OPEC. Economny changed from demand- to supply side, and the worker's struggles were silenced. However, the OPEC assets were re-invested in the Western economies, and used for arms purchases. This meant that the Western Capitalist Economies did not suffer, but the then working classes dit. The Eurodollar market was the starting point of a transformation from Keynesian towards global capitalism, which began with the rise of the financial markets and has since produced a world of weapons and digital technologies, but also a world of hunger and genocide.

Actually, the German Foreign Office writes:

Germany and the United Arab Emirates (UAE) maintain intensive diplomatic relations. The strategic partnership agreed in April 2004 is an expression of this. In September 2022, Federal Chancellor Scholz agreed to revitalise the Strategic Partnership during his visit to the UAE together with the President of the UAE, Mohamed bin Zayed Al Nahyan. In 2023, the Emirates were once again Germany's most important economic partner in the region with a bilateral trade volume of over EUR 14 billion. German imports from the UAE increased by 150% in 2023, with around 1,200 German companies based in the UAE, many of which cover the entire region including (parts of) Africa and Asia. The German-Emirati Chamber of Industry and Commerce, headquartered in Dubai and with an office in Abu Dhabi, supports the trade exchange. In addition, the energy partnership between Germany and the UAE to promote cooperation in the field of renewable energies was expanded to an energy and climate partnership in November 2021.

(C) Toshi Takamizawa

Characteristics of the UAE

Until the Arab Spring, the Emirates were a junior partner of Saudi Arabia (KSA) and followed that kingdom in many respects. Since the rise of the new Emir, Mohamed bin Zayed (MBZ) in 2004, the Emirates have followed their own reckless policy of investment and war. After 2011, the emirs, faced with the uprising in Bahrain and their high dependency on migrant labour, felt compelled to pursue their consistently counter-revolutionary course, which was not only directed against the aspirations of the rebellious populations in the neighbouring countries, but also against religious radicalisation.

A study by the SWP in 2020 named these characteristics of the UAE's foreign policy:

- The Emirates see the Muslim Brotherhood and its allies as a threat. They like to ally themselves with autocratic regimes that oppose the Muslim Brotherhood and political Islam.

- The Emirates oppose Iranian expansion, but consider Sunni Islamism to be the greater threat.

- Since the start of the Yemen war in 2015, the Emirates have been endeavouring to gain maritime control of the Red Sea and are developing into a regional power.

But a closer look indicates that their fear of democratic regimes in the region precedes other considerations. As Mahjoub (2024) writes,

„For KSA and the UAE, the Arab Spring posed an existential threat to their ultra-conservative monarchies, built on clan and tribal foundations, suppression of freedoms, inequality, discrimination, and military reliance on the United States“.

They (and their international allies) regard democracy as a threat to their investments, and they entertain militias, killing hundreds of thousands via mercenaries in Libya, Yemen and Sudan, without being responsible to any domestic or international critical public. Their model of capitalism without democracy – the dream of unchallenged accumulation and wealth – is highly attractive for right-wing policy all over the world. The winner takes it all.

2007 was the year of the big financial crisis, but also a year of rising food prizes, and hunger revolts all over Africa. Since then, UAE have been trying to accumulate not only financial assets, but they want real value for their money, like ports, real estate, land and gold. The strategic relevance of Sudan is obvious, as 80% of the food consumed or processed in UAE come from this country.

Also, since that time, the Emirs were aware of the strategic importance of the food industry. After a failed agricultural program at home, the UAE have invested big scale in agricultural schemes in Egypt, Sudan and other countries, in order to secure the alimentation of a growing population.

Notwithstanding, the following aspects should be added as well:

- Like KSA, the Emirates are pursuing the goal of diversifying their economy and becoming independent of fossil fuel exports.

- The Emirates have highly equipped armed forces, but prefer to have mercenaries and militias fight for their interests - an approach that proved its worth in the Yemen and Libyan war and was recently resumed in Sudan.

- The "multipolar world order" gives regional centres of power more leeway. In this context, the Emirates feel emboldened to ruthlessly assert their regional interests. They see themselves strong enough to defend their strategic investments. UAE are developing as a maritime power and as a factor in world trade, especially in the form of marketing African resources.

- The Emirates' economy is fuelled by the exploitation of millions of immigrant workers, primarily from South Asia. The internal security apparatus naturally serves first and foremost to maintain the power of the ruling families, but at the same time to maintain a racially differentiated labour market through recruitment and deportation, and to prevent the working class from protest and organizing itself.

More Info:

Fall / Winter 2019 MERIP: Regional Uprisings Confront Gulf-Backed Counterrevolution: Watching the events of 2011 with growing alarm, the rulers of Saudi Arabia and the UAE embarked upon a regional counterrevolution. They helped stamp out an uprising in Bahrain, intervened in Yemen’s post-uprising transition and undercut Egypt’s revolution in 2013 by backing the military coup that led to the ascent of Abd al-Fattah al-Sisi as Egypt’s newest president for life. Not only did their intervention in Egypt help overthrow an elected Muslim Brotherhood government supported by regional rivals Qatar and Turkey, but it also ensured the failure of Egypt’s democratic transition. Saudi Arabia and the UAE have showered Egypt’s military regime with billions of dollars of aid in order to secure their desired vision of regional order that places severe limits on political opposition. Although small protests in September 2019 challenged Egypt’s military rule, the “Sisi model” effectively serves as the template that Saudi Arabia and the UAE have sought to impose across the region.

08.07.20 SWP: Regional Power United Arab Emirates: Abu Dhabi Is No Longer Saudi Arabia’s Junior Partner: Since the Arab Spring of 2011, the United Arab Emirates (UAE) have been pursuing an increasingly active foreign and security policy and have emerged as a leading regional power.

10.08.23 SWP: Egypt, Saudi Arabia and the UAE: The End of an Alliance: Over the past 10 years, the de facto alliance of the governments of Egypt, Saudi Arabia and the United Arab Emirates has exercised significant influence over developments in the Middle East. The common goal has been to prevent democratic transformation, stop the rise of political Islam and counter the influence of Iran and Turkey over the region. But joint regional political interventions have so far had little success. Moreover, divergences of interest in bilateral relations between these authoritarian Arab states have come to light in recent months. The potential for conflict has become evident with regard to both economic and regional political issues and is only likely to increase in the future.

19.03.24 WAM: UAE investments abroad hit $2.5 trillion in beginning of 2024: Jamal Bin Saif Al Jarwan, Secretary-General of the UAE International Investors Council (UAEIIC) explained that the UAE is a leading investor in Egypt with around 2,000 Emirati companies across various sectors such as telecommunications, real estate, oil and gas, agriculture, and more. Al Jarwan highlighted the global strategic interest in UAE investments due to positive factors, confidence in UAE leadership, and professional investors.

He mentioned operating in 90 countries and expressed expectations for interest in investments from countries like India, Indonesia, ASEAN nations, Egypt, Morocco, and others, including certain European countries and Turkiye.

29.05.24 NLR: Colin Powers: Capital’s Emirates: At first glance, the United Arab Emirates, an oil-rich monarchy with a long history of loyalty to American empire, appears to be adapting to the multipolar order. Since 2022 it has recused itself from Washington’s economic war on Russia. Abu Dhabi, the emirate responsible for the federation’s foreign and energy policy (and the one sitting on most of its oil reserves), has blocked the exclusion of Russia from OPEC+ monthly quotas. Dubai, the region’s major freight centre, exports Russian-bound drones and semiconductors, while allowing Russian-originating bullion and diamonds to pass through its Gold & Commodities Exchange. The city’s property market and docks have been made available for Russians who need a place to hide their wealth.

The UAE also provides invaluable services to another American foe: Iran.

And then there is China, now the largest buyer of goods made in or transiting through the UAE. Roughly two-thirds of all Chinese exports to the Middle East, Africa and Europe pass through Emirati ports.

But the Emirates’ motivations are more complex than mere sovereigntism. On closer examination, many of their recent actions can be understood as respecting, rather than renouncing, obligations to empire. Despite partnerships with nonconforming states, the country remains committed to US-led neoliberal globalization: a faithful servant of what Ellen Meiksins Wood called the ‘empire of capital’.

For a different view, see NYT 08.08.23: An Oil-Rich Ally Tests Its Relationship With the U.S.: The United Arab Emirates, which has translated its wealth into outsize global influence, is diverging from U.S. foreign policy — particularly when it comes to isolating Russia and limiting ties with China.

03.06.24 Africa Report: Ports, farmland, contracts: What is UAE’s Mohamed bin Zayed seeking in Africa?: Over the past decade, the UAE has become Africa’s fourth largest foreign investor, behind China, the EU and the US. Between 2012 and 2022, the UAE injected $60bn into the continent in infrastructure, energy, agro-food, telecommunications and transport.

The petrol-driven monarchy has become a key player in the Horn of Africa and several other African countries. For Eleonora Ardemagni, a Middle East expert at the Italy-based ISPI, the UAE is “the only country capable of competing with China in both East and West Africa”.

The UAE – RSF Connection

The main reason for UAE to support the Rapid Support Forces (RSF) against the Sudanese Armed Forces (SAF), the national army, is that this war serves the UAE’s interests in defending their enormous investments in Sudan. Any successful democratic or revolutionary experiment in their sphere of influence is perceived as a threat, justifying extreme measures, even if it means destroying a country harboring such sentiments. However, this does not mean to say that SAF was a democratic player!

The United Arab Emirates is the foreign player most invested in the war. In fact, without its direct and all-around support, the RSF would not have been able to wage war to the same extent.

Sudan is key to the UAE’s strategy in Africa and the Middle East, aimed at achieving political and economic hegemony while curbing democratic aspirations. Since 2015, it has sourced fighters in Sudan to fuel its conflict in Yemen. It is the primary importer of Sudan’s gold and has multibillion-dollar plans to develop ports along Sudan’s Red Sea coast. By supporting the RSF in Sudan, it has undermined the democratic transition that followed the 2019 ouster of Omar al-Bashir, Sudan’s dictator for 30 years.

Upon the outbreak of war, UAE has reportedly established logistical operations to send weapons to the RSF through its networks in Libya, Chad, Central African Republic, South Sudan, Uganda and the Haftar and Wagner militias. It has reportedly disguised armament and supplies as humanitarian aid. In addition, RSF business, finance, logistics and PR operations are carried out from the UAE. Injured fighters are reportedly airlifted to be treated in an Abu Dhabi military hospital. And Mohamed Hamdan Dagalo (Hemedti), the RSF commander, is said to have visited a few African countries on board an Emirati airplane belonging to a company owned by an Emirati royal and adviser to the president.

In this war, UAE is on the winning side, anyway. SAF wants to sell huge areas of land just like RSF. They need the money, and both have financial debts to UAE. Both sides pay with population murdered or displaced. So, for UAE, it is a good idea to keep the war going, until the land ist cleared and the roots of democracy eradicated.

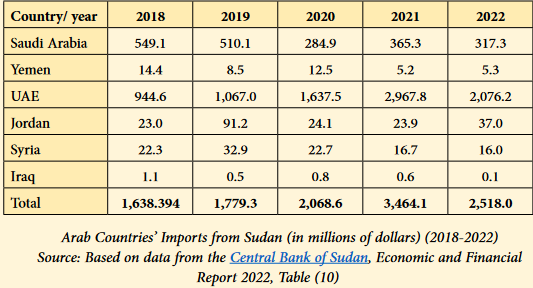

In May 2024, Nicholas Stockton, a former UN senior humanitarian adviser, published a short statement in the Guardian, how KSA und UAE could easily end the war in Sudan (It can be left aside here that the interests of KSA are slightliy different from UAE’s. KSA rather wants to pacify, and UAE has a more aggressive agenda. Note: Sudan’s exports to UAE are 7x higher than those into KSA):

„After decades of marginalisation, Sudan’s pastoralist herders started hitting back in 2003, destroying peasant farmers’ villages and converting the most favoured agricultural zones in Sudan into gigantic militarised ranches.

Since December 2023, the Rapid Support Forces have been repeating this process in Gezira, Sudan’s largest irrigated agricultural scheme. All this to take advantage of the burgeoning livestock trade with the Gulf states and Saudi Arabia, and now re-established as Sudan’s leading export industry.

This is the principal driver of Sudan’s civil war. The fastest and most effective way of stopping it would be to control this trade and thereby remove the incentives that underlie the brutal land clearances. Saudi Arabia and the Gulf states could stop the war in Sudan at a stroke by adopting ethical trade policies that exclude all livestock exported from Sudan’s killing fields.“

The Al-Fashaga region, which is in dispute between Ethiopia and Sudan, is a prime example of the joint interests of UAE and RSF. We quote from Atar, 12.08.24:

The underlying conflict between the Sudanese Armed Forces (SAF) and the RSF is fundamentally economic, centred on their relationship and trade dynamics. The military confrontation with Ethiopia in the Al-Fashaga region is a prime example. On September 6, 2020, the SAF attempted to reclaim Al-Fashaga, which had been occupied by Ethiopia since 1991, taking advantage of Ethiopia’s preoccupation with its internal conflict against the Tigray forces.

During this time, Hemeti offered no support to the SAF, neither logistically nor in terms of combat units, despite his interest in the Eastern Sudan file. Notably, Hemeti visited Addis Ababa during the military confrontation, where he was received by Ethiopian Prime Minister Abiy Ahmed and toured economic sites with his younger brother, Al-Goni Hamdan Hemeti, who manages the economic portfolio for the Hemeti family.

Hemeti did not directly intervene in the Al-Fashaga issue, except by supporting a UAE initiative to resolve it. This proposal suggested that the SAF withdraw to pre September 2020 borders, with the UAE investing in Al-Fashaga’s land, distributing returns as 40 per cent to Sudan, 40 per cent to Ethiopia, and 20 per cent to the UAE.

The Al-Fashaga issue marked a turning point in the relationship between the SAF and the RSF.

But this is not the only reason why RSF the prime partner for the Emirates.

- First of all, supporting SAF would stop the war earlier, which is not the intention of the Emirates.

- The ruler of UAE, MBZ, and the leader of RSF, Hemedti, are both business men. Without sentiments, they follow the same logic of money and power. MBZ is running a state like a family business, and Hemedti dreams of doing the same in Sudan.

- RSF have been a loyal partner to UAEs since many years. After the genocide in Darfur, 2003, the then Janjaweed established strong commercial ties to UAE, and have since then delivered gold and cattle from Darfur. Also, they manned the Security to guard the UAE`s enterprises in Sudan, and sent militiamen (and children) to Yemen in 2015.

- UAE do not particularly like the Islamist influences in the SAF, although they do not mind doing business with them as well. They like the economy of war better which Hemedti stands for. And they like the areas of investment which RSF is clearing for them.

Table from Atar issue 10

Paving the Way for RSF

In the months leading up to the war, UAE-affiliated networks intensified efforts to fortify RSF’s presence on social media, laying the groundwork for the militia’s des-information and misinformation campaigns. At the onset of the war, a Dubai-based expert team managed RSF’s media and propaganda, portraying the militia favourably to European decision-makers.

MBZ met with the leaders of Chad and Ethiopia, garnering support for the RSF, and paved the way for pompous visits by Hemedti in the countries of the „Belt of Bribes“ to which MBZ had payed billions for their cooperation. (The Belt of Bribes: Djibouti and Ethiopia, and Kenya, Uganda, CAR and Chad).

Especially „Flipping Chad“ was important for the logistics of the war. During summer 2023, the remote Chad town of Amdjarass had turned into a “boom town” at the border to Darfur. According to Succès Masra, a former prime minister of Chad, the Emirates promised the president of Chad, Mr. Déby a $1.5 billion loan, nearly as big as Chad’s $1.8 billion national budget a year earlier. The obvious aim: To allow the emirates sending weapons to the RSF via Chad. “It’s very clear: The U.A.E. is sending money, the U.A.E. is sending weapons,” he said according to the New York Times (21 Sept 2024).

Amdjarass became the heart of an “elaborate covert operation” being run by the UAE to back the RSF, “supplying powerful weapons and drones, treating injured fighters and airlifting the most serious cases to one of its military hospitals”. Up until 30 September, the flight tracker Gerjon recorded 109 cargo flights coming from the UAE, stopping briefly at Entebbe in Uganda and then flying on to Amdjarass. (Gerjon has since deactivated their account following what they described as “a recent incident” which, they said, meant they “no longer feel safe”.) As flights from Uganda to Chad can be tracked, the RSF and its backers have been trying to bring cargo into Sudanese airspace, where it cannot be followed (Rickett 2024).

The UAE also facilitated weapon shipments for the RSF through connections with Libya, Central Africa, Uganda, and the Haftar and Wagner militias. “These extensive and sustained supplies ranged from small and light weapons to drones, anti-aircraft missiles, mortars and various types of ammunition,” according to a UN expert report 2023, citing sources among armed groups and tribal leaders in eastern Chad and Darfur.

Recently, French-made Galix defence system has been seen in RSF militia formations on armoured vehicles manufactured in the United Arab Emirates (UAE). This "Multi-Purpose Passive Self-Defence System for Land Platforms" also offers Grenades for "crowd management".

The Role of RSF

The UAE have financed the Sudanese government already in the 1980s, and demanded repayment in the form of food exports. This was a strong driver for the modernisation of agriculture in Sudan. After 1989, in the times of international sanctions on Sudan due to Omar Al-Bashirs policy of genocide and backing terrorism, the UAE, though a western ally, didn’t care about these sanctions, and took over the monopoly as buyer, while the RSF also expanded it's business into protection money, drug trafficking, usurious loans and car theft. The war in Yemen brought even greater petrodollar profits from 2014 onwards, as Hemedti recruited thousands of young mercenaries for the then anti-Houthi alliance of Saudi Arabia and the UAE.

In November 2014 the EU initiated the Khartoum Process, and heavily relied on the RSF as a border guard. The EU supplied them with resources, but more than all with the international reputation of being an official Border Guard.

Under the UAE's control and funding, the military conflicts in Sudan and the UAE's support for the RSF are being used to advance the UAE's financial and strategic interests in Sudan. This is why the continuation of military conflicts in the region is in the UAE's interest as it guarantees control over the region under war conditions.

Hemedti's realm, RSF, is a family business like that of MBZ. The Daglo family became very wealthy thanks to the explosion of the gold price after 2007, as it controlled the extraction and the smuggling abroad of the precious metal from Darfur. Supporting this family business is also much cheaper for the UAE than paying for a state with a hungry population.

„The war that the RSF is waging, with the support of the UAE and others, is not a conventional war, but rather a war to dismantle the Sudanese state and subjugate the Sudanese people“.

Mahjoub, Husam (2024)

More Info:

26.11.19 Reuters: Exclusive:Sudan militia leader grew rich by selling gold: Now a Reuters investigation has found that even as Hemedti was accusing Bashir's people of enriching themselves at the public's expense, a company that Hemedti's family owns was flying gold bars worth millions of dollars to Dubai.

Current and former government officials and gold industry sources said that in 2018 as Sudan's economy was imploding, Bashir gave Hemedti free rein to sell Sudan's most valuable natural resource through this family firm, Algunade. At times Algunade bypassed central bank controls over gold exports, at others it sold to the central bank for a preferential rate, half a dozen sources said. A central bank spokesman said he had no information about the matter.

09.12.19 Globalwitness: Exposing the RSF's secret financial network: An apparently genuine cache of leaked documents obtained by Global Witness show the financial networks behind Hemedti and the RSF. Not only have they captured a large part of the country’s gold industry through a linked company, but the leaked bank data and corporate documents show their use of front companies and banks based in Sudan and the UAE.

09.06.20 ECFR: Bad company: How dark money threatens Sudan’s transition: The United Arab Emirates and Saudi Arabia appear to be positioning a paramilitary leader known as Hemedti as Sudan’s next ruler, but the military is fiercely hostile towards him. Western countries and international institutions have let the civilian wing of the government down: they failed to provide the financial and political support that would allow Prime Minister Abdalla Hamdok to hold his own against the generals.

10.11.21 Quantara: The UAE – pulling Sudanese strings: The Emiratis signalled early on their support for the toppling of Bashir in contacts with elements of the opposition and armed forces in 2019, at a moment when the military and paramilitary were mulling the removal of the president in a power grab. UAE officials assumed that the military and the RSF would emerge as the dominant force in a new Sudan. The Emirati foreign ministry stressed in a statement in the wake of the coup "the need to preserve the political and economic gains that have been achieved…

29.09.23 NYT: Talking Peace in Sudan, the U.A.E. Secretly Fuels the Fight: From a remote air base in Chad, the Emirates is giving arms and medical treatment to fighters on one side in Sudan’s worsening war, officials say.

24.05.24 Guardian: It’s an open secret: the UAE is fuelling Sudan’s war – and there’ll be no peace until we call it out: The Emirates is arming and supporting one side in the conflict, but UK and US officials have shied from confronting it

12.08.24 Atar: Hassan Alnaser:Sudan and the UAE: The issue is not war: Economics of UAE RSF liaison, quoted extensively above

01.09.24 MEE: How Sudan's RSF became a key ally for the UAE’s logistical and corporate interests: Analysts say Abu Dhabi is exploiting the African country's resources at the expense of locals, using Sudanese militias with impunity. Experts and observers argue that part of the UAE's motivation for funding the devastating hostilities is to guarantee its access to Sudanese land, seaports, and mineral and agricultural resources, including livestock and crops.

21.09.24 NYT: How a U.S. Ally Uses Aid as a Cover in War: The United Arab Emirates is expanding a covert campaign to back a winner in Sudan’s civil war. Waving the banner of the Red Crescent, it is also smuggling weapons and deploying drones.

Mechanisation and Militarisation of Agriculture

Climate change, increasing water scarcity, and spreading desertification have led to an agriculture in conflict mode, including conflicts between small peasants and agroindustry, as well as between peasants and pastoralists. This athmosphere of conflict lead to to a militarised form of farming, from sowing, and harvesting, to export. So the RSF has also gained income and reputation as a Security actor, guarding farms, harvests, and cattle transports. The war in Darfur, 2003 – 05, was a strong driver in this militarization process.

Since the war in Darfur, Sudan has become the main supplier of fresh meat to the Gulf states. The mechanisation of Sudanese agriculture was accelerated by the vision of Sudan as a “breadbasket for the Arab region”, which was already in 2003 endorsed by the Gulf States. This vision, along with the Sudanese debt to the Gulf States, has increased the pressure to displace population, and increase productivity in the agrarian sector.

"The militarization of rural production is not limited to the war-ravaged regions of Sudan, but is now an integral part of rural life. A special security force, in which the RSF is also involved, is tasked with monitoring the harvest season, when armed gangs roam the countryside to capture the freshly harvested crops still waiting in the fields to be properly stored and transported. Even more far-reaching is the militarization of pastoral livelihoods. A driving factor was the increasing commercialization of pastoralism and the need to secure the treks of herds to export markets.“

Edward Thomas and Magdi el Gizouli (2021)

Modernisation Policy in Sudan as the Basis for Land Seizures

Throughout Sudanese history, there have always been social disputes over the issues of food security and access to, and use and control of, arable land. For a long time, the use of agricultural land was tied to historically traditional negotiation processes. Against the backdrop of the climatic conditions, a mixture of agriculture linked to the rainy seasons (millet, sorghum, wheat, etc.) and associated migratory livestock farming (sheep, camels, cattle, etc.) developed in many regions.

With colonialism and the post-colonial modernisation policies that followed, the state tried to give a legal status (property rights) for the disposal of land. In 1979, the Unregistered Land Act of 1970 was put into force. As a result of the subsequent modernization projects, there were frequent disputes with the respective regional residents or immigrants. All large agricultural farm projects and also the dam and irrigation projects could only be enforced by police and military means.

„This legal dispossession of unregistered lands, which account for 90% of all lands in the country, appears to be the most common form of expropriation in Sudan. Land seizures have been common in the states of South Kordofan and Blue Nile, and in the eastern region. The state has seized land and leased it out to private entities for development of large mechanized farming operations. The government has used gunships and helicopters to clear people from villages to secure land for the development of oil fields.“

More Info:

Sept. 2016 Sudan Democracy First Group: Land Use, Ownership and Allocation in Sudan (PDF): The first part of this research focuses on the spatial impact of resource-extracting economies, notably the foreign acquisitions of agricultural land. The case studies from South Kordofan/Nuba Mountains, Blue Nile, Northern and River Nile states and Eastern Sudan, show how rural people experience "their" land vis-à-vis the latest wave of privatization and commercialization of land rights. The second part of this research will address and analyze lack of transparency and corruption in the field of land use, ownership and allocation.

2017 Consilience: Land Grab and Institutional Legacy of Colonialism: The Case of Sudan: Over last decade Africa has experienced an unprecedented amounts of land being concessioned, leased or sold to business, corporations or foreign sovereign capital. The land question (who can acquire or have access to land) and the political question (who belongs in the political community) are connected to the citizenship question. These questions are among the most politicized in Africa. This article answers the following questions:

Who benefits from the ‘land grabs’?

What can a critical analysis of the ‘land grabs’ tell us about the

contemporary politics of development?

The first section of this article discusses and provides the intellectual background that informs today’s land rush. The second section discusses the competing actors involved in the land grab, winners and victims. Here I will argue that the majority of victims of land dispossession in the African context are peasants, pastoralists, nomadic, and trans- boundary communities, whose land management system is based on customary land tenure.

2018 GIGA: Brotkorb und Konfliktherd – Landinvestitionen in der Republik Sudan: Kaum ein anderer Staat verfügt über größere landwirtschaftlich nutzbare Flächen als der Sudan, jedoch droht eine Zunahme internationaler Landkäufe, bestehende Konflikte zu verschärfen.

Schätzungen zufolge hat die sudanesische Regierung seit dem Jahr 2011 Konzessionen mit einer Gesamtfläche von mehr als acht Millionen Hektar an nationale und internationale Investoren erteilt – das entspricht ungefähr der Größe Österreichs.

Der Sudan erwartet von den Investitionen substanzielle Beiträge zum Wirtschaftswachstum des Landes, positive Beschäftigungseffekte und eine verbesserte Ernährungssicherheit für weite Teile der Bevölkerung.

Ein großer Anteil der freigegebenen Landflächen wurde zuvor von Kleinbauern oder pastoralen Gruppen genutzt, denen die Enteignungen die wirtschaftliche Lebensgrundlage entzieht. Die Folge sind teils gewaltsame Gegenreaktionen. In den Konfliktregionen des Landes besteht das Risiko, dass sich die Verlierer der Landinvestitionen gewaltsamen Gruppierungen anschließen.

Die Investitionen der UAE belaufen sich auf 1,7 Millionen ha bis 2017. UAE ist nach KSR (2 Millionen ha) der zweitgrößte Investor.

July 2023 Insecurity insight: The Sudan Crisis, Conflict and Food Insecurity: This briefing discusses specific conflict incidents with clearly foreseeable consequences for civilians and civilian objects necessary for achieving food security. In doing so, it aims to help break the vicious cycle between armed conflict and food insecurity

03.07.24 Grain: From land to logistics: UAE's growing power in the global food system: In the pursuit of its own food security, the UAE, like other Gulf states, has been getting control of land to develop farm operations in Sudan. Right now, two Emirati firms –International Holding Company (IHC), the country’s largest listed corporation, and Jenaan – are farming over 50,000 hectares there. In 2022, a deal was signed between IHC and the DAL group – owned by one of Sudan’s wealthiest tycoons – to develop an additional 162,000 ha of farmland in Abu Hamad, in the north. This massive farm project, backed by the UAE government, will connect to a brand-new port on the coast of Sudan to be built and operated by the Abu Dhabi Ports Group. The economic stakes around this project are mammoth. But so are the political ones. The current port of Sudan, which the project will completely bypass, is run by the Sudanese government.

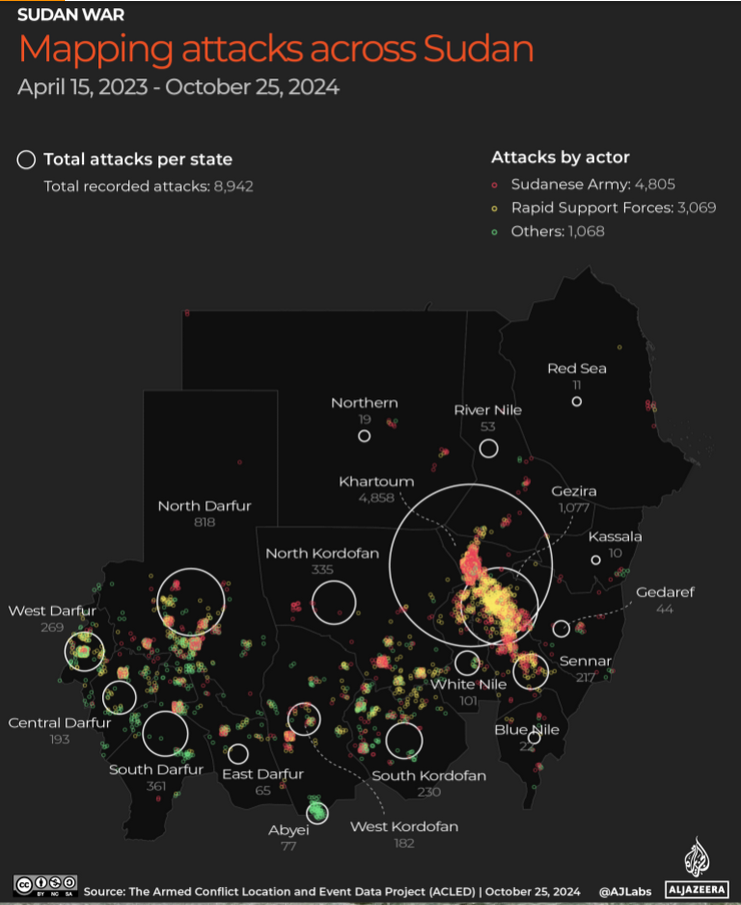

Please find a recent overview on the course of the war on AJE

The War of Displacement

Since the beginning of the war, April 15, 2023, the RSF mercenaries have more or less systematically displaced the populations from areas which they either want to sell for agroindustry or use for cattle ranches.

This started with the Massacre of Geneina, June 06, 2023. During that Battle, 370 000 persons were displaced from that town and it’s surroundings. In October, RSF took Nyala and spread the war to Gezira, into the main irrigated agricultural area. Many thousand fled to the regional capital, Wad Madani, which was taken by RSF in December. In May 2024, during the Battle of Al Fasher, the Rapid Support Forces have razed settlements to the ground in an area of one and a half square kilometres within two weeks- through bombing, fire and ground troops." In June, RSF killed more than 200 persons in a massacre in a village of Gezira. Hundreds thousand fled. RSF is spreading footages of their atrocities on their channels, thus spreading fear and fostering displacement. June 2024 not only witnessed the escalation of war in Omdourman, but also in the states of Sennar and Gedaref, which are also important agricultural areas. The attack on Sennar again led to mass displacement. Sudan’s war parties systematically used starvation as a weapon. At the same time, floods displaced more people, but also paused the war. In October 2024, The RSF’s use of terror tactics in Gezira State resembles the tactics they previously have used in Darfur. At the same time, RSF burned 17 villages in Dar Zaghawa of North Darfur State, according to satellite imagery.

Source: AJE 14.11.24 Watch the video here

UNHCR speaks of more than 11,6 million displaced persons, as of November 11, 2024, and the Norwegian and the Danish Refugee Councils are speaking of “historic proportions” of a starvation crisis which is going on at the present moment.

More Info:

Spring 2019 MEIRIP: The UAE and the Infrastructure of Intervention: A focus on the multiple concurrent forms of intervention by states like the United Arab Emirates (UAE), which boasts the world’s largest humanitarian hub, illustrates the role humanitarian logistics can play in amplifying and projecting military power. UAE has employed humanitarian aid as a tool to distract attention from its ongoing military campaign, with Emirati aid agencies inviting journalists to accompany them while distributing supplies to areas under their military control. (This is about Yemen)

10.01.24 Roape: Exposing the murderers – the UAE involvement in the war in Sudan: Husam Osman Mahjoub examines the growing and profound influence of the UAE and Saudi Arabia in the region over the years, and Sudan in particular. He argues that war in Sudan drives the final nail into the coffin for the democratic aspirations of the peoples of the Arab and African region.

14.10.24 MC.Info: Ignoring the root causes of the disaster: the EU and Sudan: Ten million displaced people, two million who have fled to neighbouring countries – but the EU's chief concern relates to the 8,000 Sudanese who have made it into the EU “illegally,” most of them on the deadly route across the Mediterranean. The document refers to “resilience.” It is “European” resilience, not that of the people fleeing. In the interplay between coastguards and militias, the EU’s asylum system and Frontex, what is meant by resilience other than “keep them out”?

UAE Investment Strategies

The UAE has evolved from a player in petrodollar recycling and junior of KSA to a regional geopolitical force. Even before MBZ came to power in 2004, he had a significant influence on the strategies of the UAE. MBZ stands for an authoritarian, neoliberal style of leadership, he is opposed to Islamist groups connected to the Muslim Brotherhood, and considers democratic processes unacceptable.

In March 2024, the Secretary General of the UAE International Investors Council (UAEIIC), Jamal Bin Saif Al Jarwan , proudly announced that the United Arab Emirates had cemented its position as a leading regional and global player in foreign direct investment. He estimated that the total value of Emirati investments abroad, spanning both the government and private sectors, will reach a staggering 2.5 trillion US-$ (2.500.000.000.000) across 90 countries by early 2024. He also expressed the expectation of interest in Emirati investment in countries such as India, Indonesia, ASEAN, Egypt, Morocco and others, including some European countries and Turkey.

The strategic investments include

- the logistics sector - a network of ports and logistics centres along the East African coast. The UAE is a key player in linking military, humanitarian and trade logistics.

- Expansion and control of the gold trade and legalisation of illegal gold. Through this type of gold smuggling, the RSF has not only become a private mercenary army, but is also used by the UAE to protect and expand its economic investments

- Ensuring food security - through land grabbing, the mechanization of farming and the purchase of companies in the food processing industry, the UAE has become a net exporter of food.

- Close cooperation with the RSF, but also with other private security companies that serve to secure geopolitical interests (Sudan, Yemen, Egypt, Ethiopia, Eritrea, etc.) or simply to secure economic investments.

- Investment in neo-colonial “Green New Deal” projects and the commodification of forests (certificate trading). In Zimbabwe, Liberia, Zambia and Tanzania, for example, huge areas of forest the size of Britain were acquired for CO2 certificate trading. Fot that reason, UAE was a strong backer of "fossil fuels vow" on the Cop29 conference, in opposition to KSA.

Apart from this, also see these recent examples:

- In Tanzania, UAE have been under scrutiny by various human rights groups for violently displacing the Maasai population out of their ancestral land to give way to a wildlife corridor for trophy hunting and elite tourism, utterly disregarding the Indigenous people’s rights to their traditional livelihood. Amnesty reports on mass arrests and brutal forced evictions. In total, almost 150,000 Maasai people are facing displacement.

- In Germany, the VAE-owned Abu Dhabi National Oil Company (Adnoc) is in the process of investing 16 billion € to acquire a majority stake in the Leverkusen-based plastics group Covestro. This is the first time that a company from the Gulf has sought a majority stake in a Western European enterprise.

More Info:

Nov. 2020 Thesentry: Understanding Money Laundering Risks in the Conflict Gold Trade From East and Central Africa to Dubai and Onward: The record-breaking rise in world gold prices in recent years has driven a new artisanal gold mining and refining rush in conflict-affected and high-risk areas in East and Central Africa. Annually, over $3 billion in gold mined in the affected regions, including conflict gold from which armed groups and army units profit, reaches international markets in the United States, Europe, Asia, and the Middle East,7 according to investi-gations by The Sentry and other organisations.

Nearly all of this gold is first imported to Dubai, UAE, which has rapidly risen over the past 20 years to become one of the world’s largest gold trading centres, particularly for artisanal and small-scale gold from sub-Saharan Africa, Latin America, and South Asia. 9 Artisanally mined gold from the DRC, South Sudan, and CAR is mainly smuggled or exported to one of six neighboring countries—Uganda, Rwanda, Cameroon, Kenya, Chad, or Burundi—before being exported to Dubai. Sudan mainly exports directly to the UAE.

30.11.23 Guardian: The new ‘scramble for Africa’: how a UAE sheikh quietly made carbon deals for forests bigger than UK: Agreements have been struck with African states home to crucial biodiversity hotspots, for land representing billions of dollars in potential carbon offsetting revenue

29.05.24 Africa Report: UAE: DP World makes a play for Africa: The Dubai-based logistics giant is both a thriving business and a geopolitical soft power tool. Today the company employs more than 20,000 people across the continent. It operates ports and logistics centres in nine African countries – Algeria, Angola, Djibouti, Egypt, Mozambique, Nigeria, Rwanda, Senegal and South Africa – as well as the self-declared state of Somaliland.

23.07.24 Ispionline: Minerals (also) for Defence: Unlocking the Emirati Mining Rush: The UAE is heavily investing in the mining sector in Africa and Latin America to adapt to the energy transition towards renewables and achieve national industrial goals. Mining deals allow the UAE to cope with the energy transition towards renewables and develop national industrial goals. There is something, however, that distinguishes the UAE from its Gulf neighbours. Abu Dhabi is developing its national defence industry and advanced defence technologies well ahead of Saudi Arabia.

19.07.24 ADHRB: The United Arab Emirates’ unethical foreign policy in Africa: The United Arab Emirates (UAE) has emerged as a significant player on the African continent, leveraging its economic and strategic initiatives to deepen its influence, involving investments in infrastructure, ports, and telecommunications, alongside military engagements and political alliances. However, UAE’s presence is not without controversy, particularly regarding allegations of neo-colonialism and human rights abuses, which cast a shadow over its intentions.

30.11.23 Guardian: Who is the UAE sheikh behind deals to manage vast areas of African forest?: Through the firm Blue Carbon, Sheikh Ahmed Dalmook al-Maktoum’s carbon offsetting deals, which could one day be worth billions, have led to questions about previous business ventures. Through the United Arab Emirates-based company Blue Carbon, the sheikh’s deals cover a fifth of Zimbabwe, 10% of Liberia, 10% of Zambia and 8% of Tanzania, collectively amounting to an area the size of the UK – and more are expected.

Logistic and Trade

„Over the past decade, the UAE has become Africa’s fourth largest foreign investor, behind China, the EU and the US. Between 2012 and 2022, the UAE injected $60bn into the continent in infrastructure, energy, agro-food, telecommunications and transport.

The UAE has become one of the important hubs within the global logistics space: Its network of state-owned companies such as Dubai Ports World (DP World - which controls 87 ports in 40 countries worldwide - and the Abu Dhabi Ports Group has a strong presence in East Africa (Tanzania, Somaliland, Mozambique, Sudan, Djibouti, Puntland), but also in Rwanda, Congo, Angola, Senegal, Guinea as well as in South Africa, Algeria and Egypt). Also they run the Etihad and Emirates airlines, and position themselves centrally in international supply chains and global commodity flows.

The strategic concept of linking military, humanitarian and trade logistics is currently visible in the support for the RSF organised via this structure through arms deliveries via Uganda and Chad airports, which is organised under the guise of humanitarian aid (emergency aid). The DIHC (Dubai International Humanitarian City) is part of DP World, a network of UN Humanitarian Response Depots with locations in Ghana, Italy, Malaysia, Spain and Panama, which manage the supply chains of emergency items for UN agencies and NGO partners.

Strategic Commodities

The United Arab Emirates has become one of the largest export markets for African gold producers, with around 34 billion dollars worth of gold from across the continent making its way into the country in 2022. The Emirates also act as a legalisation gateway for illegal gold. The RSF gained access to Sudanese gold deposits there during the genocide in Darfur. The gold was fed into international circulation via the Emirates and the expansion of the RSF into an international mercenary company was promoted.

The UAE is building on its already established position as a hub for gold processing and has invested heavily in strategic commodity interests since 2021. This ranges from Brazil to Peru and covers the African continent from Mauritania to Kenya. The focus is on all metals required for the “Green New Deal”.

More Info:

17.04.24 WPR: The UAE Has Set Its Sights on Africa’s Critical Minerals: The United Arab Emirates is rapidly emerging as a major player in the mining sector in Africa. The country is already a hub for the licit and illicit trade in gold and gemstones from across the continent. Its new targets are mines producing metals that are key to the green transition to low-carbon energy sources. With its oil-dependent economy vulnerable to the global shift away from fossil fuels, Abu Dhabi is trying to secure a central place in the new energy economy.

01.10.24 Africa Report: UAE gold refiners suspected of handling illegally mined African gold: The suspicion of UAE processing illegally mined gold has led key gold traders, such as Swiss company, Metalor Technologies, to refuse to handle gold refined in the UAE.

Industry regulators, industry bodies and international market overseers now face the challenge of imposing strict diligence standards on the UAE refineries, which will have implications for African miners of gold in war-torn and unstable countries.

The proceeds of the sales in funding criminal groups, which includes buying arms and for corruption, were exposed in 2020 when Global Witness alleged that UAE-based Kaloti bought gold through an intermediary which in turn bought it from mines in Sudan’s Darfur region controlled by violent groups.

Food Security, Land Grabbing

After the “water riots” and “bread riots” in 2007 and the uprisings throughout the Arab world (from 2011), a new strategic direction for the UAE became evident, and this included access to food and land grabbing.

Since 2008, the UAE has played an increasingly important role in the purchase or long-term leasing of land. They have bought around 960,000 hectares of farms abroad, including around 200,000 hectares in Sudan.

Food crops include wheat, sorghum, alfalfa, but also the supply of animals and meat (sheep, camels, donkeys).

The United Arab Emirates, a country that has almost no ecological basis for large-scale agriculture, has an agricultural export value which is now greater than that of Egypt. In 1991, food exports from the UAE amounted to 9.4 million dollars; in 2021, these had soared to 14.9 billion dollars, which is the highest export ratio in the Arab world.

More Info:

16.02.21 ak: »Die Erde hat keinen Preis«: Kämpfe gegen die Inwertsetzung natürlicher Ressourcen in ländlichen Räumen waren und sind integraler Teil der Bewegungen in Nordafrika

03.07.24 Grain: From land to logistics: UAE's growing power in the global food system: In the pursuit of its own food security, the UAE, like other Gulf states, has been getting control of land to develop farm operations in Sudan. Right now, two Emirati firms –International Holding Company (IHC), the country’s largest listed corporation, and Jenaan – are farming over 50,000 hectares there. In 2022, a deal was signed between IHC and the DAL group – owned by one of Sudan’s wealthiest tycoons – to develop an additional 162,000 ha of farmland in Abu Hamad, in the north. This massive farm project, backed by the UAE government, will connect to a brand-new port on the coast of Sudan to be built and operated by the Abu Dhabi Ports Group.

Summer 2024 MERIP: Extractive Agribusinesses—Guaranteeing Food Security in the Gulf: Today GCC states—which import around 90 percent of their food—rank among the world’s highest in terms of food security and affordability, on par with many OECD states. Their citizens spend a relatively low share of their income on food.According to the Land Matrix database, between 2000–2022, Gulf states acquired more than two million hectares of agricultural land abroad.[4] Over a third of it was in other Arab countries. Saudi Arabia, the UAE, Qatar and Kuwait acquired some half a million hectares in Sudan. Egypt is another site of significant Gulf purchases at 157,851 hectares.

Inside UAE: The New Dystopia

Workers Under Constant Threat: the Labour Market in the UAE

In the oil crisis of 1974, the Gulf States were actors in an epochal attack on the European working class. We have pointed out the role of petrodollar recycling. At the same time, the Emirates were also an actor in a new, post-national utilisation of mobile labour. As early as 1975, 64% of Emirati residents were non-nationals, and their share has grown steadily since then. In 2016, almost 90% of the 9 million residents were less-entitled foreigners. According to “le monde diplomatique” (1/2023) the population in UAE is composed as follows: 10% are Emiratis, 30% other Arabs or Iranians, 50% Southeast Asians and 10% Westerners (they do not mention Non-Arab Africans).

There are huge differences between the Westeners and the vast majority of exploited workforce. People from Asia and the WANA region are predominantly employed in low-skilled jobs, while highly skilled workers are mainly recruited from the USA and Europe. Labour migrants from Sudan and the WANA region, who have a language advantage over workers from Asia, are largely employed in the army, the police and the public sector. Women are only a small part of the migrant labour force. They work largely in private households and are particularly exposed to dependence on their employers through the kafala system. In 2014, the International Trade Union Confederation estimated the number of enslaved domestic workers in the Gulf States at 2.4 million. They mainly came from India, Sri Lanka, the Philippines and Nepal.

The Emirates reformed their labour law in 2017 and brought the status of employees in private households in line with general labour law. Meanwhile, there are tens of thousands of illegalised workers, including many who have fled the Kafala system and people who work on tourist visas and as visa overstayers and are mercilessly at the mercy of their bosses.

For the majority of the workers from Southeast Asia, the wages are low, housing is precarious, and access to health service is highly expensive. The broshure by Vital signs (2022), has published a few interviews with low-paid workers, like the following:

K.W. described crowded living quarters with eight to fifteen men sharing a room, and three toilets and two baths for sixty men, twelve hours of work, six days a week for salaries of 1150 dirhams (US $313) rather than the 2400 dirhams (US $653) promised.

Another worker on medical care:

The person who arranged my visa and tickets advised me to take Panadol, and Brufen [Ibuprofen] to Dubai because they are often needed and difficult to obtain in Dubai. We always requested someone arriving from Pakistan to bring medicines

along with him. Everyone had their own medicines in the labor camp.

The ‘offshore citizens’ are controlled via their ‘permanent temporary status’. Work visas are usually ‘sponsored’ by institutions or companies; better-off workers can ‘sponsor’ a family reunion. After dismissal, workers have 6 months to look for a new job before they are deported. Unauthorised protests are punishable by law.

The Emirati themselves - unless they belong to the stateless Bidun minority, which makes up a quarter of the local population - have so far largely favoured well-paid positions in the public sector. In Vision UAE 2031, the state has so far been trying, with rather moderate success, to persuade them to take up employment in the private sector (‘Emiratisation’).

More Info:

Cave 2013! 18.09.13 MPI: Labor Migration in the United Arab Emirates: Challenges and Responses: With immigrants, who come particularly from India, Bangladesh, and Pakistan, comprising over 90 percent of the country's private workforce, the UAE attracts both low- and high-skilled migrants due to its economic attractiveness, relative political stability, and modern infrastructure

Cave 2025! 17.03.15 Guardian: The global plight of domestic workers: few rights, little freedom, frequent abuse: A quarter of the world’s 53 million domestic staff have no labour rights, leaving them vulnerable to exploitation, beatings and sexual assault

Book 2019: Offshore Citizens. Permanent Temporary Status in the Gulf:

Chapters:

1 - Limbo Statuses and Precarious Citizenship

2 - Making the Nation: Citizens, “Guests,” and Ambiguous Legal Statuses

3 - Demographic Growth, Migrant Policing, and Naturalization as a “National Security” Threat

4 - Permanently Deportable: The Formal and Informal Institutions of the Kafāla System

5 - “Taʿāl Bachir” (Come Tomorrow): The Politics of Waiting for Identity Papers

6 - Identity Regularization and Passport Outsourcing: Turning Minorities into Foreigners

November 2022 Vital Signs: THE COST OF LIVING: MIGRANT WORKERS’ ACCESS TO HEALTH IN THE GULF (PDF): This second report examines the specific issue of migrant workers’ access to healthcare in the Gulf, focusing again on

workers in low-paid sectors of the economy.

Wikipedia: Migrant workers in the United Arab Emirates: In 2019, the UAE had the second-largest international migrant stock in the world at 87.9% with 8.6 million migrants (out of a total population of 9.8 million). Non-citizen, migrant workers, account for 90% of its workforce.

Security and Military

How can a „country“ with 1 million „citizens“ and 9 million foreign workers hold stability? And how can regional military dominance be executed?

The answer lies also in in the efficiency of the security apparatus. which in itself employs foreign labour. There are thousands of police officers and military personnel, Pakistani or Sudanese migrants in the lover ranks, and US and European advisors in the higher ranks. And all of the foreign security forces will be disposed of after retirement.

Le Monde Diplomatique wrote about the UAE’s high-tech toolkit for mass surveillance and repression in January 2023:

‘Emiratis are a minority in their own country,’ says Andreas Krieg , a security specialist at King’s College, London. ‘Surveillance technology allows them to be omnipresent.’

The people I spoke to recognise that mass surveillance impinges on freedom of expression. Many preferred to discuss sensitive topics face-to-face rather than on the phone. ‘We assume — or rather, we know — that we are under constant surveillance, and that it’s dangerous to say anything politically sensitive, even on WhatsApp,’ said a European expatriate who asked to remain anonymous.

‘The 9/11 attacks were a turning point. They led to a rejection of all forms of political Islam, and tighter surveillance of mosques.’

The UAE, which relies extensively on foreign labour, also changed its policy on migration. The second explained that ‘until then, the UAE had welcomed large numbers of migrant workers from Arab countries. After 9/11, background checks were stepped up, especially for preachers and teachers. Migrants from Southeast Asia are considered less dangerous, and find it easier to get visas.’

The UAE's authoritarian agenda abroad reflects how tightly it controls politics at home, suppressing any form of opposition or dissent. Activists, journalists and ordinary Emiratis who dare to speak out against the regime face harsh penalties, including imprisonment, torture and other grave human rights violations. The UAE's repressive tactics are not limited to dissidents and activists, but to anyone perceived as a threat to its interests, including international businesspeople operating within the country's borders.

The United Arab Emirates (UAE) has recently launched an extensive campaign to silence opposition, marked by a stark disregard for justice and human rights. This crackdown includes a series of arrests, summonses, and deportations targeting individuals who criticize Israel’s actions in Gaza, blatantly violating the right to freedom of speech.

The State Security Apparatus (SSA)

As HRW wrote recently, the SSA is the highest authority on UAE state security matters.

Created on June 10, 1974, the SSA and has played a leading role in the crackdown on peaceful dissent in the country, starting with the mass arrests campaign launched in 2013 against Emirati civil society. That year, SSA agents arrested, secretly detained, and tortured over a hundred lawyers, judges, students, and other intellectual figures who signed a petition asking for democratic reforms. […] Since then, the SSA has continued to perpetrate widespread human rights violations, including enforced disappearance, torture, and arbitrary detention.

The SSA operates in great secrecy under the direct control of the UAE President, on the basis of a law that has never been made public. According to a leaked draft from the Emirates Detainee Advocacy Center, the law, which was amended in 2003, grants the SSA broad and unconstrained powers, allowing the SSA to act without any institutional, judicial, or financial oversight. For example, it can gather and analyze information on “any political activity” and “monitor social phenomena.” The SSA President has the power to place suspects in custody up to three months and make any decision that is binding on all security apparatuses. The SSA is also allowed to establish security offices in any federal ministry, government office, embassy, or consulate abroad.

Recent examples of SSA activities were the crackdown on 44 civil rights defenders in 2023 and the crackdown on Bangladeshi workers protesting against their own government.

As the aforementioned DAWN-Report describes, spying and surveillances by SSA reaches far beyond the borders of UAE:

The United Arab Emirates has demonstrated a blatant disregard for the rule of law and individual rights, engaging in widespread spying and surveillance tactics against critics and dissidents both within and outside its borders. The Emirati regime has been accused of employing sophisticated cyber-surveillance tools to hack into the phones, email accounts and digital communications of activists, journalists and even foreign government officials.

This cyber espionage violates the privacy and rights of targeted individuals and poses a broader threat to the security and stability of democratic processes worldwide. [ ...] Such repression is transnational, extending far beyond the UAE's borders through the use of covert operatives, mercenaries and exploitation of the mechanisms and institutions of international law enforcement.

As Wikipedia notes, UAE is among the users of the Pegasus spyware, distributed by the Israeli NSO Group. The establishment of the state security service is strongly supported by former military personnel from Western countries, who serve the UAE as consultants through private companies.

An important role is played by former US intelligence officer Larry Sanchez, a confidant of the ruling family and head of CAGN Global Ltd in Baltimore. ALUAALLC, headed by an ex-Royal Air Force intelligence officer, and the company DarkMatter, which works in the field of intelligence cyber security, also play an important role. Erik Prince (Blackwater) also founded the company Reflex Response (R2) in Abu Dhabi in 2010, in which 51 per cent of the shares are held by people from the Emirates.

Police

The 7 emirates have their own police force each. We limit our presentation to the Dubai and the Abu Dhabi police forces.

The Dubai Police Department has a reputation for being one of the most efficient and well-equipped police forces in the world. There are strict law enforcement policies, Police drones and camera surveillance cover any public space, and as soon as a group of persons would gather, the police would be there very soon. Dubai Police recorded an average emergency response time of 2 minutes and 24 seconds in the third quarter of 2023.

The Abu Dhabi Police uses a wide-spread Facial Recognition System. The UAE is the first country to match the system with criminal lists at border control points. Also, there there is a wide-spread Iris technology. The system is in place at all UAE entry and exit ports and works in conjunction with the immigration authorities.

Military

For their policy of war and investment, UAE mainly uses local militias, beside their relations to state actors in their Belt of Bribe. So they did in Yemen, in Libya with Haftar, in Ethiopia with Abiy, or in Sudan with the ongoing support to RSF.

The Yemen war triggered e new strategy for UAE, “how a small and very ambitious nation is projecting its power beyond its borders.”The Guardian (21.12.2018) wrote:

The Emiratis appear to be the only alliance members with a clear strategy. They are using private armies that they have created, trained and funded in a bid to crush both jihadi militancy and Islamist political parties such as al-Islah. Across the southern coast – where the UAE is allied with the separatist Southern Movement, which is opposed to both the Houthis and the Hadi government – the Emiratis have built a series of military camps and bases, and established what is essentially a parallel state, with its own security services who are not accountable to the Yemeni government. UAE and its proxy forces, are accused of disappearing and torturing al-Islah members, anti-Houthi fighters from rival factions, and even activists and critics of the Saudi-UAE coalition. Yemeni ministers have taken to referring to the Emiratis as an “occupation force”.

The Sudanese forces in Yemen originally comprised members of the Sudanese Armed Forces (SAF) and the RSF. Gradually, an increasing number of fighters originated from the RSF, fostering independent ties with the UAE and KSA, distinct from the Sudanese army and state.

The UAE has integrated the RSF into its military system, which relies on contracts with notorious companies and personalities such as Blackwater, and increasingly on mercenaries. Eric Prince, the founder of Blackwater, has been involved since 2010 in building an elite force responsible for the UAE Presidential Guard and conducting military operations in Syria and Yemen. This force included mercenaries from apartheid-era South Africa, Colombia, Morocco and other countries.

Expanding this system during the Yemen war, the UAE established bases in Eritrea (Assab) and Somaliland (Berbera), offering its domestic and international facilities to RSF personnel. Estimates suggest the RSF deployed around 40,000 troups to Yemen, funded by substantial payments from the UAE and KSA. These funds not only enhanced the RSF’s power and influence, but also attracted tens of thousands of Sudanese youths, including the very young, to join its ranks.

In 2021, UAE extensively supported the Ethiopian Abiy Regime via an air bridge. Like today, UAE was trying to conceal where the flights took off and where they landed. Since then, UAE is building an ambitious partnership with Abiy (and Somaliland), which is observed with suspicion by Egypt, KSA, and Somalia. In fact, Abiy in Ethiopia plays a role similar to that one envisaged for Hemedti in Sudan: modernisation and commodification of the capital, repression of the peripheral population and promotion of agribusiness.

But when did UAE deploy their own forces? They did so in Somalia in the 1990s, in Libya in order to support Haftar, and in Afghanistan along with US missions, and they fought against Houti militias in Yemen in 2015 – 2018. But all this happened on a limited scale, as businessmen have nothing to waste. They are a reliable partner for the USA, in their war on terror, and they approve any military action against jihadist movements. And also against the regime in Iran, as long as they are not involved directly. So, at the moment, they are happy about Israel continuing their war against Iran’s allies, and do not at all care about Palestinians.

The liaison with Israel has been established with the Abraham Accords in 2020. It has Isreal given a free hand to follow the fascist concept of a Great Israel. However, UAE is careful about a balance of powers and has just recently started a process of negotiations with the Iranian Regime. Like in the Yemen war, they are reluctant to be drawn into an anti-Iran alliance. They are out for profits, not for the costs of war.

The UAE Armed Forces are well-equipped with modern and advanced military hardware, sourced from various countries, primarily the United States, France, and the United Kingdom. The equipment covers a wide range of military platforms, including aircraft, naval vessels, armoured vehicles, and sophisticated weaponry. The UAE had a military budget of 23.19 billion US dollars in 2021. The share of military expenditure in GDP was 5.2% in 2017.

During the Yemen war, since 2015, the EU was the most important trading partner and a prominent supplier of weaponry for the Gulf states, especially Saudi Arabia and UAE. The UAE is one of the largest customers of the German defence industry; in the period 1999-2009, military equipment worth more than €1.5 billion was purchased. In 2017, France delivered military equipment worth €227 million to the Emirates. But also the Emirati defence conglomerate, EDGE produces around 100 products and is a weapons exporter itself.

As of 2023, the Emirati defence conglomerate EDGE had about a quarter of its orders come from abroad. The UAE armed forces are now signing the majority of their supply contracts with Emirati companies, as emphasised by the 2023 edition of the International Defence Exhibition & Conference (IDEX) in Abu Dhabi. The Emiratis intend to gain control over the supply chain of the raw materials they acquire. As for the defence industry, the UAE plans to obtain a strategic edge above regional competitors through the expansion of its civilian industrial base and the control of critical materials and their supply chain – factors that have previously hindered the growth of the defence industry in the MENA region.

Like the rest of society, the military is very much characterised by a two-tier structure: it consists of foreign mercenaries on the one hand and local officers on the other. Due to a lack of trust in the foreign mercenaries, they are neither assigned officer positions nor strategically important tasks. The proportion of foreigners (particularly Pakistanis) in the army is comparatively high at 30 %. In addition, numerous former members of the US armed forces were and are active as trainers and advisors. (Wikipedia DE)

More Info:

01.11.22 SIPRI: Arms transfer and SALW controls in the Middle East and North Africa: Challenges and state of play: The year 2019 saw the first-ever instance of an arms industrial conglomerate from an Arab state—EDGE from the United Arab Emirates (UAE)—entering SIPRI’s list of the top 25 largest arms-producing and military services companies. This is just one illustration of the growing role that some states in the Middle East and North Africa (MENA) play in the global arms trade—not only as arms importers but also increasingly as arms producers and exporters.

January 23 LMD: UAE’s high-tech toolkit for mass surveillance and repression: The United Arab Emirates has pioneered the extensive use of surveillance technology to keep tabs on its own citizens. Data is being collected and also analysed on a massive and unprecedented scale, making people fear nothing they say or write is truly private.

06.06.24 DAWN: How the UAE Subverts Democracy Far Beyond Its Borders: one of America's closest partners in the Middle East not only represents the very rule of monarchs and the moneyed, but is also actively trying to subvert democracy around the world, including in the United States. The United Arab Emirates has demonstrated a blatant disregard for the rule of law and individual rights, engaging in widespread spying and surveillance tactics against critics and dissidents both within and outside its borders. The Emirati regime has been accused of employing sophisticated cyber-surveillance tools to hack into the phones, email accounts and digital communications of activists, journalists and even foreign government officials.

10.06.24 HRW: Fifty Years Since Establishment, UAE State Security Apparatus Should End Widespread Abuses of Emiratis’ Fundamental Rights: SSA has continued to perpetrate widespread human rights violations, including enforced disappearance, torture, and arbitrary detention.

23.07.24 Ispionline: Minerals (also) for Defence: Unlocking the Emirati Mining Rush: The UAE is heavily investing in the mining sector in Africa and Latin America to adapt to the energy transition towards renewables and achieve national industrial goals. Mining deals allow the UAE to cope with the energy transition towards renewables and develop national industrial goals. There is something, however, that distinguishes the UAE from its Gulf neighbours. Abu Dhabi is developing its national defence industry and advanced defence technologies well ahead of Saudi Arabia.